nd sales tax rate 2021

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Calendar year 2021 taxable sales and purchases totaled 203 billion a 92 increase from 186 billion in 2020.

State And Local Sales Tax Rates 2018 Tax Foundation

The Bismarck sales tax rate is.

. The sales tax is paid by the purchaser and collected by the seller. Wayfair Inc affect North Dakota. Enter the North Dakota income tax withholding shown on a 2022 Form W-2 Form 1099 or North Dakota Schedule K-1.

2020 rates included for use while preparing your income tax deduction. The North Dakota sales tax rate is currently. Wayfair Inc affect North Dakota.

2021 Tax Tables 49850 49900 637 549 699 549 49900 49950 638 549 700 549 49950 50000 639 550 701 550 At least But less than Single Married filing jointly Married filing sepa- rately. 373 rows Lowest sales tax 45 Highest sales tax 85 North Dakota Sales Tax. South Dakota and Utah did so only in.

Explore 2021 sales tax by state. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. The County sales tax rate is.

2021 state and local sales tax rates. Find your North Dakota combined state and local tax rate. The North Dakota sales tax rate is currently.

Groceries are exempt from the North Dakota sales tax Counties and cities can charge. At the present time the City of Northwood has a 15 city sales use and gross receipts tax. Effective January 1 2021 the City of Northwood has adopted an ordinance to.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Did South Dakota v.

This is the total of state county and city sales tax rates. This rate includes any state county city and local sales taxes. Sales Taxes Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of North Dakota.

City of Fargo North. 596 North Dakota has state sales tax of 5 and allows local. North Dakota sales tax is comprised of 2 parts.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. The more than nine percent increase in taxable sales and. Pursuant to Document 144641 as adopted May 5 2021 the boundaries of the City of Elgin will change for sales and use tax purposes effective April 1 2022.

The 2018 United States. 30 rows North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000. Compare 2021 sales tax rates by state with new resource.

Exemptions to the North Dakota sales tax will vary. Updates are posted 60 days prior to the changes becoming effective. The Fargo sales tax rate is.

Please refer to the following. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Minot North Dakota is.

The County sales tax rate is. The North Dakota sales tax rate is currently. Any sales tax that is collected belongs to the.

The latest sales tax rate for Cando ND. The 2018 United States. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

Did South Dakota v. 5 Average Sales Tax With Local. With local taxes the total sales tax rate is between 5000 and.

100 rows NORTH DAKOTA STATE COUNTY CITY SALES TAX RATES 2021 Register Online This page lists an outline of the sales tax rates in North Dakota. The minimum combined 2022 sales tax rate for Williston North Dakota is. The North Dakota sales tax rate is currently.

Also enter North Dakota income tax withholding shown on a 2021 North. Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax.

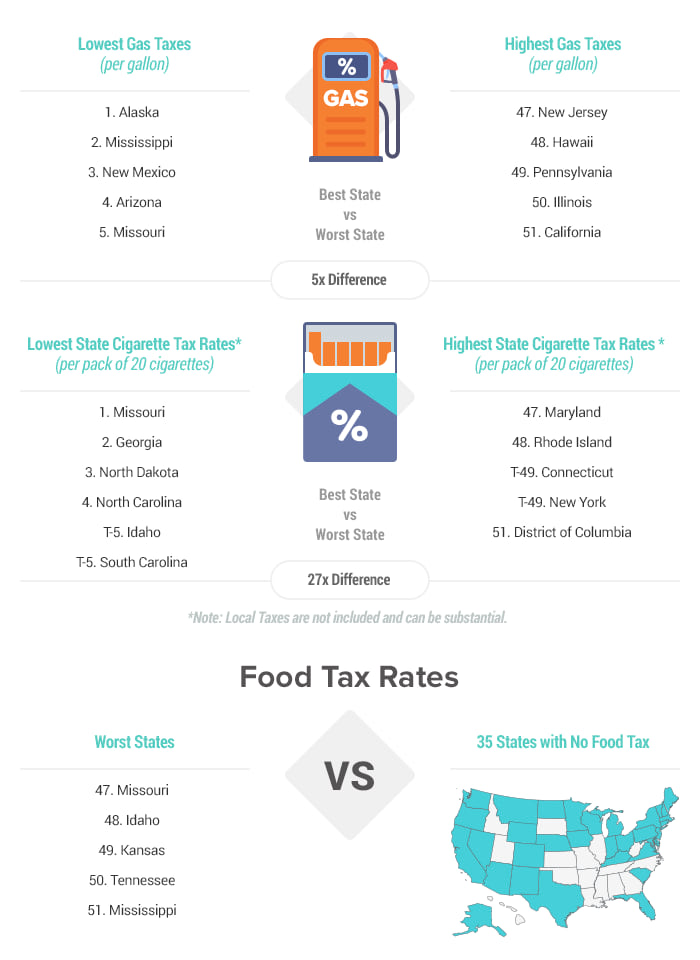

States With The Highest Lowest Tax Rates

State Sales Tax Rates And Combined Average City And County Rates Download Table

Sales Use Tax South Dakota Department Of Revenue

North Dakota Office Of State Tax Commissioner

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

What Small Business Owners Need To Know About Sales Tax

Income Tax Update Special Session 2021

How To Charge Your Customers The Correct Sales Tax Rates

Sales Taxes In The United States Wikiwand

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

These Are Other States With Tax Breaks On Diapers And Menstrual Products Fortune

Welcome To The North Dakota Office Of State Tax Commissioner

Colorado Sales Tax Rate Rates Calculator Avalara

Inflation Bites Into State Sales Tax Hauls Warns Of Boom S End

How Racial And Ethnic Biases Are Baked Into The U S Tax System